Crypto Fear and Greed Index

Key Takeaways

- The Crypto Fear and Greed Index is a market sentiment tool that measures investor emotions on a scale of 0 (Extreme Fear) to 100 (Extreme Greed).

- It serves as a contrarian indicator; high fear can signal that cryptocurrencies are undervalued and present a buying opportunity, while high greed may suggest the market is overextended and due for a correction.

- The index is not a predictive tool but should be used alongside technical analysis (TA) and fundamental analysis (FA) to make more informed trading decisions.

The Crypto Fear and Greed Index gauges the emotional pulse of the crypto market. It compiles data like Bitcoin volatility, market volume, and social media sentiment to produce a simple score.

Traders use this score as a contrarian signal, following Warren Buffett's famous advice to "be fearful when others are greedy, and greedy when others are fearful."

High fear suggests investors are overly worried, potentially creating a buying opportunity. Extreme greed indicates market euphoria (FOMO), signaling it might be time for caution.

What is Crypto Fear and Greed Index?

Let's break it down. The Crypto Fear and Greed Index is essentially a thermometer for market sentiment. It tells you whether the current mood of the crypto market is leaning more towards a panic-selling frenzy (Fear) or an irrational buying spree (Greed).

The concept isn't new. It was created by Alternative.me and inspired by the original Fear & Greed Index from CNNMoney, which analyzes the mood of the stock market. The core idea is rooted in a simple truth about markets: they are driven by human emotion.

What this really means is that extreme fear tends to drive prices down, sometimes below their intrinsic value. On the flip side, unchecked greed can lead to speculative bubbles and over-inflated prices. The index simply quantifies this emotional rollercoaster.

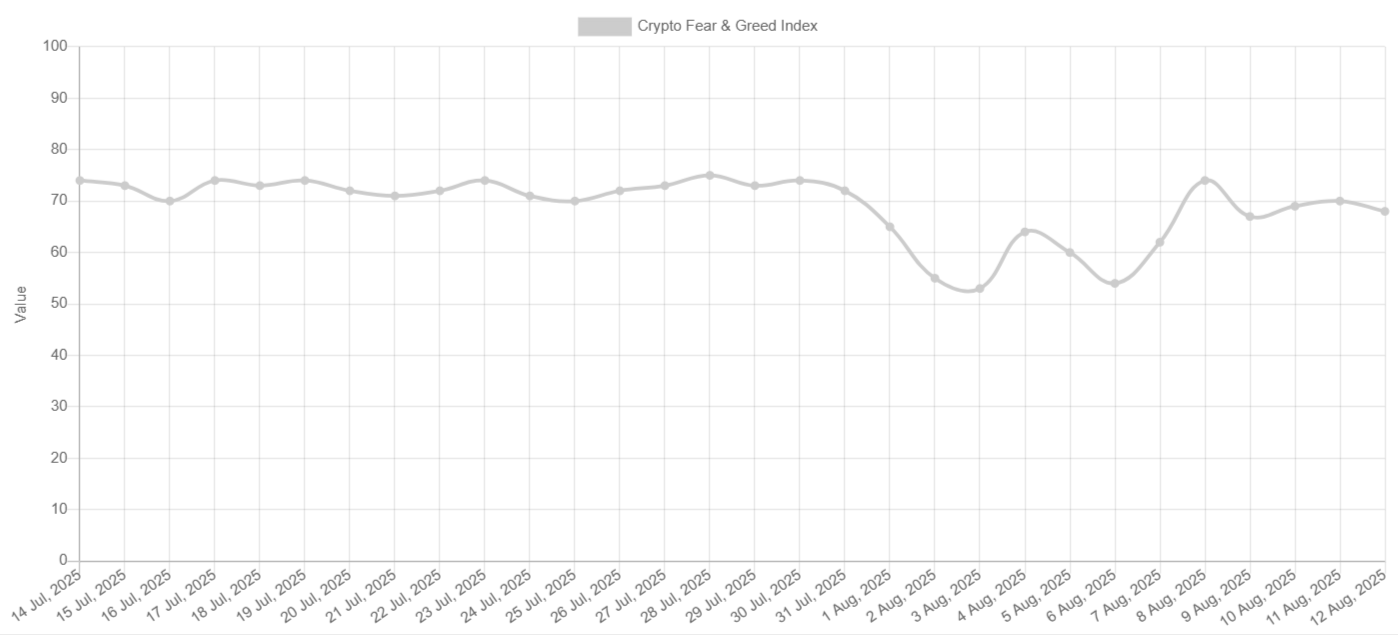

Live Crypto Fear and Greed Index Chart

Words are great, but data is better. Below is a live chart showing the current score of the index. This makes your page a go-to resource for checking the market's pulse in real-time.

The chart shows you today's score, yesterday's score, and the reading from last week and last month. This historical context is crucial for understanding the direction of market sentiment. Is fear intensifying, or is greed starting to cool off? The chart tells the story at a glance.

How is the Crypto Fear and Greed Index Calculated?

The index isn't just a random number; it's a composite score derived from several key data points, each with a specific weight. Understanding these components shows you exactly what's influencing the score.

Here's the thing: while the original formula has been tweaked over time, the core factors remain consistent.

Data source for weightings: Alternative.me

Understanding the Score (0-100)

The final score is simple to interpret:

- 0-24: Extreme Fear: Widespread panic in the market. Often seen as a potential buying opportunity by contrarian investors.

- 25-49: Fear: Investors are worried, but not in a full-blown panic.

- 50: Neutral: The market is on the fence, with no strong emotional bias.

- 51-74: Greed: Investors are becoming overly optimistic, and FOMO starts to set in.

- 75-100: Extreme Greed: Market euphoria is at its peak. This can be a signal that the market is due for a market correction.

How to Use the Index for Crypto Trading

Knowing the score is one thing; using it to make smarter decisions is another. The Crypto Fear and Greed Index is a cornerstone of contrarian investing. The goal is to act opposite to the prevailing market emotion.

Strategy 1: Identifying Buying Opportunities (Extreme Fear)

When the index flashes "Extreme Fear," it means the market is pessimistic. This is often when prices are at their lowest, as fearful investors sell off their assets.

For a contrarian, this is a signal to start looking for bargains. It doesn't mean you should blindly buy everything. Instead, use it as a trigger to research solid projects that have been unfairly beaten down by the negative market sentiment.

A prime historical example was the market bottom in mid-2021, where the index lingered in Extreme Fear for weeks before the market began a massive recovery.

Strategy 2: Spotting Potential Corrections (Extreme Greed)

When the index shows "Extreme Greed," it's a warning sign. FOMO is rampant, and investors are piling in, often without caution. This euphoria can push prices to unsustainable levels.

This doesn't mean you should immediately short the market. Rather, it's a signal to be cautious. It might be a good time to:

- Take some profits on existing positions.

- Avoid opening new, risky long positions.

- Set tighter stop-losses to protect your gains.

Interpreting these signals and executing trades at the right moment can be demanding. This is where automated tools and expert insights become invaluable.

Platforms like Zignaly offer a profit-sharing model where you can connect your capital with expert traders called wealth managers. They analyze indicators like the Crypto Fear and Greed Index as part of their broader strategy, allowing you to leverage their experience.

Explore Top-Performing wealth management services on Zignaly Market Place!

Limitations and Accuracy: What the Fear & Greed Index Can't Do

Now for a reality check. The Crypto Fear and Greed Index is a powerful tool, but it is not a crystal ball. Understanding its limitations is crucial for using it effectively and managing risk tolerance.

- It's a sentiment indicator, not a timing tool: The index tells you how the market feels, not where it's definitively going next. Extreme Fear can last for weeks, and prices can always go lower before they recover.

- No guarantees: An "Extreme Fear" reading is not a guaranteed buy signal, just as "Extreme Greed" doesn't guarantee a crash. It's a signal of probability, not certainty. Always combine it with your own technical analysis and fundamental analysis.

- It's Bitcoin-centric: The index's data is heavily weighted towards Bitcoin. While BTC sentiment often leads the market, some altcoins can and do move independently.

- Social media can be gamed: The social media component is vulnerable to manipulation by bots and coordinated campaigns. While data providers work to filter this out, it's a known challenge.

So, can it predict a market crash? No. But it can warn you when the conditions for a crash, irrational exuberance, and high greed are present.

Final Thoughts

The Crypto Fear and Greed Index is an essential tool in any serious trader's arsenal. By providing a clear snapshot of market psychology, it helps you cut through the noise and make more rational decisions.

Remember, its real power lies in its application as a contrarian indicator. When the crowd is panicking, it may be time to look for opportunities. When the crowd is euphoric, it may be time for caution. Never use it in isolation, but as a crucial piece of your overall trading strategy, the Crypto Fear and Greed Index can give you a significant edge.

Ready to dive deeper into market analysis? Check out our other guides on trading indicators to build out your toolkit.

FAQ - Crypto Fear and Greed Index

How does the crypto fear and greed index compare to the VIX?

Both measure market fear, but they operate in different worlds. The VIX Index measures the implied volatility of S&P 500 options for the traditional stock market. The Crypto Fear and Greed Index is specific to the crypto market and uses different data sources, like social media and Bitcoin dominance.

What's the difference between the 'Fear and Greed Index' and the 'Bitcoin Fear and Greed Index'?

They are almost always used interchangeably. The original index by Alternative.me primarily focuses on Bitcoin sentiment because its price action and mood heavily influence the entire crypto ecosystem.

Is a score of 50 on the index good or bad?

A score of 50 is Neutral. It's neither good nor bad. It simply indicates a balance between fear and greed in the market, without a strong emotional pull in either direction.

Can I use the index for altcoins?

Indirectly, yes. While the index is Bitcoin-centric, its sentiment readings are a strong barometer for the broader crypto market. Extreme fear in Bitcoin usually means even greater fear (and potentially deeper discounts) in more volatile altcoins.

How often is the crypto fear and greed Index updated?

The index is updated daily (every 24 hours). You can check the latest score on authoritative data provider websites like Alternative.me or CoinMarketCap.

Can the crypto fear and greed index predict a market crash?

No, the Crypto Fear and Greed Index cannot predict a market crash, as it measures current sentiment, not future events. It acts as a warning signal, where "Extreme Greed" suggests the market is vulnerable and conditions are ripe for a correction. Think of it as a smoke detector for market risk, not a crystal ball.

What's a good contrarian strategy using the crypto fear and greed index?

A good contrarian strategy is to act opposite to the prevailing market emotion. When the index shows "Extreme Fear," consider it a potential buying opportunity as assets may be undervalued. Conversely, when it signals "Extreme Greed," exercise caution, consider taking profits, and avoid entering risky new positions.