Proof of Stake (PoS)

In the rapidly evolving world of blockchain technology, it is crucial to ensure the security and integrity of transactions. This is achieved through consensus mechanisms – the rulebook by which participants agree on the validity of new data added to the blockchain. Among these, Proof of Stake (PoS) stands out as a modern and increasingly popular fault-tolerant mechanism for achieving consensus.

Proof of Stake protocols function by choosing transaction validators in a way that takes into account the size of their stake in a particular cryptocurrency. It is designed to be more energy-efficient and scalable than old-school method of Proof of Work (PoW). This innovative approach is a smart alternative for verifying transactions on a blockchain.

Unlike Proof of Work, which relies on "miners" solving complex mathematical puzzles through intensive computation and consuming lots of energy, Proof of Stake (PoS) in blockchain selects "validators" based on the amount of cryptocurrency they voluntarily "stake" (commit) as collateral. This commitment acts as a financial incentive to act fairly honestly and protect the proof of stake network.

The concept of Proof of Stake emerged in 2011, and Peercoin launched it in 2012 as the first crypto to use this PoS-like system. This innovative model became popular because it allows anyone holding a certain amount of cryptocurrency to jump in securing the network. That's why today's PoS cryptos are more appealing because they promise quicker transaction finality, lower fees, and a significantly lighter footprint on our environment compared to PoW.

How does Proof of Stake Algorithm Works?

The basic idea behind the Proof of Stake algorithm is straightforward. Proof of stake validators need to lock their coins before they can take part in creating new blocks. At this point, these locked coins are used as collateral, so unscrupulous validators can't win. If a validator attempts to cheat the system, their stake can be "slashed" means they end up getting barred from the network and also lose their stake. The network rewards honest validators when they forge new blocks and punishes those who try to cheat the system. This approach is great for generating trust with all concerned.

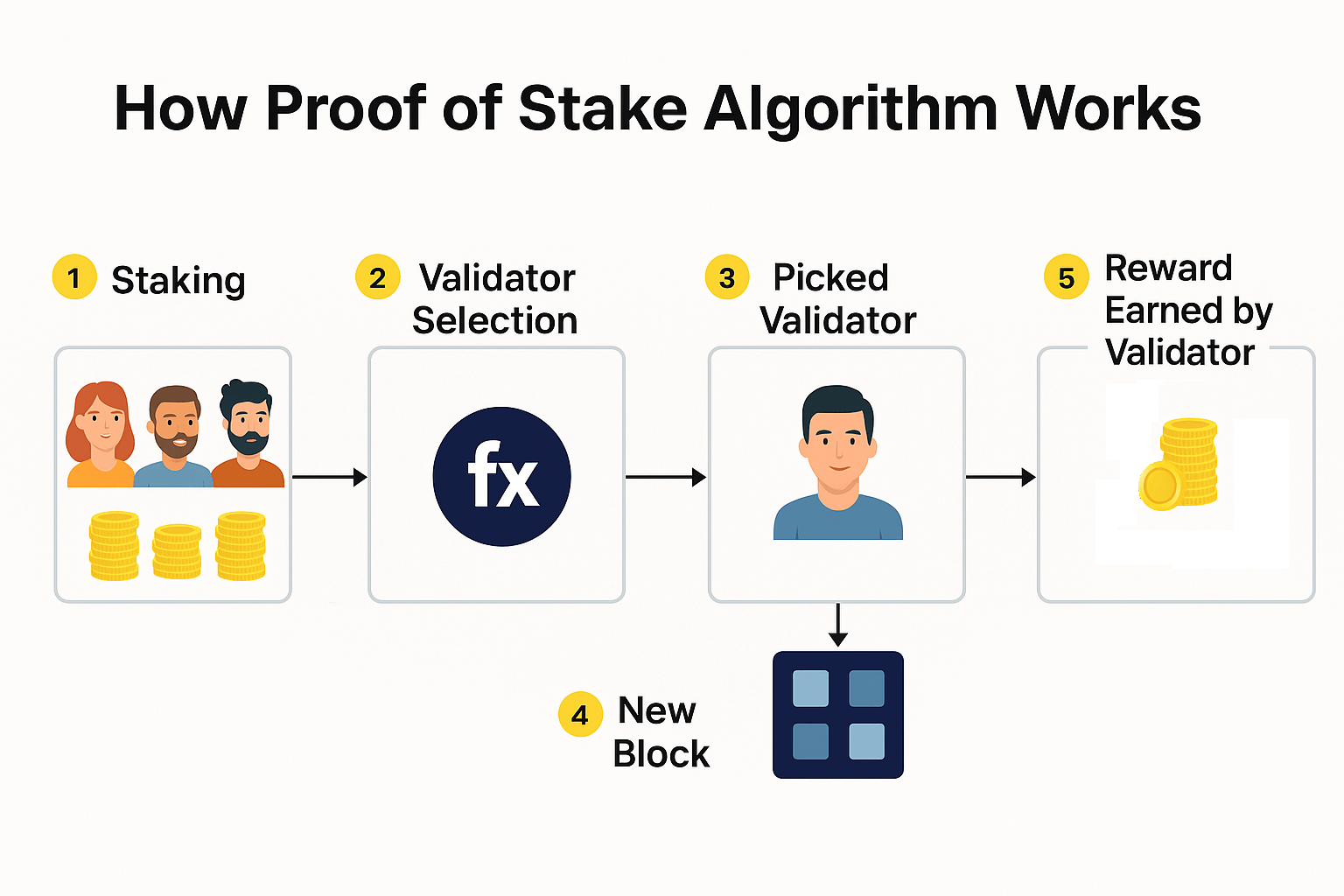

Here's a rundown of how Proof of Stake algorithm works:

- Staking: Users voluntarily commit a certain amount of their crypto tokens by "locking" them in a smart contract. This is called staking period and during this time, you can't spend them. You can do this on your own ("solo staking") or by teaming up with a staking pool or service.

- Validator Selection: The network's special algorithm then picks a validator randomly, to propose and validate the next block of transactions. The more crypto you've staked (i.e. stake weight), the higher your chances of being chosen. This randomness keeps things fair and unpredictable, while your stake size gives you a bigger voice.

- Block Validation and Proposal: The chosen validator proposes a new block of transactions to the network. Other validators then verify the proposed block's validity

- Reward Block Validators: If that block is good to go and the network accepts it, the successful validator gets a reward. This usually comes in the form of freshly minted crypto or transaction fees – sometimes both!

- Slashing Mechanism: To keep everyone honest, if a validator acts maliciously (like trying to approve fake transactions, being offline too long, or messing with the rules), they face penalties. This "slashing" means they lose some or all of their staked tokens and might even be booted from the validator squad. This strong incentive helps maintain the integrity of the proof of stake crypto ecosystem. This whole setup creates a super secure economic environment. Validators have a clear financial reason to be honest, which helps keep the entire Proof of Stake system reliable.

This whole setup creates a highly secure economic environment. Validators have a clear financial incentive to be honest, which helps keep the entire Proof of Stake ecosystem reliable.

5 Key Advantages of PoS

Proof of Stake brings a lot to the table, and that's why it's popping up in so many new blockchain projects:

- Energy Efficient: This is a big one! Unlike PoW's energy guzzling, PoS needs very little power to create and validate blocks. It's a much greener way to run a blockchain.

- Enhanced Scalability: PoS can make transactions much faster and networks able to handle way more activity. Without the need for those complex puzzles, blocks can be created much quicker, which means a more scalable network.

- Decentralization Potential: While there are always debates, PoS can open the door to more participation. You don't need expensive, specialized hardware, so more people can stake their assets and help secure the network. This can lead to a more spread-out, decentralized validator group.

- Economically Secure: Proof of stake validators have their own money on the line. Any bad behavior directly threatens their investment, which is a powerful deterrent.

- Lower Barrier to Entry for Participants: Even if solo staking might require a hefty amount of crypto, staking pools and liquid staking options mean that even folks with smaller holdings can join in, earn rewards, and help secure the network. It's about democratizing access.

These key benefits of PoS cryptos make them incredibly appealing to both developers building the next big things and investors looking for sustainable blockchain ecosystems.

Proof of Stake vs. Proof of Work

The classic debate between Proof of stake vs proof of work usually boils down to energy use, security, and how centralized (or decentralized) they tend to be. Here's a quick comparison:

Proof of Stake is definitely becoming the go-to method for modern blockchain designs because of its sustainability and scalability potential. Meanwhile, PoW still reigns supreme for networks that prioritize the absolute highest level of decentralization and a battle-tested security model over energy efficiency.

Types of Proof of Stake Implementations

While the basic principles of Proof of Stake remain consistent, there are various implementations of PoS, each designed to optimize different aspects of a blockchain network:

1. Delegated Proof of Stake (DPoS):

In this model, crypto holders actually vote for a small group of "delegates" or "witnesses." These chosen few are then responsible for validating transactions and proposing blocks. It's often super fast and scalable, but sometimes, having fewer validators can lean a bit more towards centralization.

2. Leased Proof of Stake (LPoS):

Found in networks like Waves, LPoS lets smaller crypto holders "lease" their coins to a full node. This helps that node gain more "stake weight," and in return, the leaser gets a share of the rewards, all without actually giving up ownership of their coins.

3. Bonded Proof of Stake:

Many modern PoS systems, including Ethereum's, operate on a "bonded" model where validators must explicitly bond (lock) their tokens to participate. This bond can be slashed for misbehavior.

4. Nominated Proof of Stake (NPoS):

Polkadot uses this one. NPoS allows crypto/token holders ("nominators") to back reliable "validators" with their stake. Both nominators and validators share in rewards and risks (including slashing). This helps create a more spread-out and secure validator group.

5. Pure Proof of Stake:

This is a simpler version where participation is directly linked to how much you've staked, with less emphasis on delegation or complex voting.

It's important to note that Proof of Burn in blockchain is a distinct consensus mechanism where tokens are permanently removed from circulation to show commitment and create scarcity – but it's not a type of Proof of Stake itself.

Real-World Proof of Stake Examples

Many of the big names in blockchain have either adopted or moved to Proof of Stake, really showing its potential and how well it works in the real world. These are some of the most notable proof of stake coins:

- Ethereum (after The Merge): This was a massive shift!. Ethereum successfully moved from Proof of Work to Proof of Stake in September 2022 (known as "The Merge"). This significantly cut its energy consumption and set the groundwork for future upgrades.

- Cardano (ADA): Built on its own Ouroboros PoS protocol, Cardano focuses on formal verification and research-driven development, aiming for security and sustainability.

- Solana: Combines elements of PoS with a unique "Proof of History" mechanism to achieve exceptionally high transaction throughput and low fees.

- Polkadot: A scalable multichain network that uses Nominated Proof of Stake (NPoS) to secure its relay chain and parachains, enabling interoperability.

- Tezos (XTZ): Utilizes a variant of Delegated Proof of Stake where any token holder can participate in the validation process ("baking") or delegate their rights.

- Avalanche (AVAX): This network uses a unique PoS protocol that allows for high throughput and quick transaction finality, complete with multiple chains for different functions.

These new PoS coins really show the industry's shift towards more sustainable, scalable, and economically smart blockchain architectures.

Potential Disadvantages and Challenges of Proof of Stake

While it has a lot going for it, there are some disadvantages of Proof of stake that are important to consider:

- Centralization Risk: One common worry is that really wealthy participants, who can stake a ton of crypto, might end up holding too much validation power. This could potentially make the network more centralized, with just a few big players having a lot of influence.

- "Nothing at Stake" Problem: In some early PoS designs, validators didn't really lose much by trying to validate on multiple competing blockchain versions at the same time. This could open up security holes. Thankfully, modern PoS protocols use "slashing" mechanisms that penalize validators for this kind of mischief.

- Long-Range Attacks: This is a clever, sophisticated attack where someone might get hold of old validator private keys and try to create a completely new, longer chain starting way back in history. Modern PoS networks use "finality gadgets" and checkpoints to make these attacks financially impossible.

- Validator Downtime: If a chosen validator goes offline or just isn't doing their job, it can mean missed block proposals and a slower network. But, again, slashing penalties for downtime encourage validators to stay online and engaged.

- Bootstrapping a New Network: Getting a strong, decentralized group of validators off the ground can be tough for brand-new PoS networks. How the initial tokens are distributed can really affect who has staking power down the line.

- Liquid Staking Risks: While convenient for keeping your assets liquid, liquid staking solutions come with their own set of smart contract risks and the possibility of "impermanent loss" for those holding liquid staking tokens.

The good news is that people are constantly researching and developing solutions to these challenges. Many projects are implementing clever mechanisms to make their Proof of Stake networks even more secure and decentralized.

Staking with Zignaly: An Accessible Entry Point

If you're curious about participating in the crypto economy and earning some potential rewards, platforms like Zignaly offer a super accessible way to get involved with "staking." Now, it's important to understand that Zignaly's ZIGStake program isn't directly a consensus-layer Proof of Stake mechanism means it's not securing a blockchain's core consensus. Instead, it mirrors the incentives of PoS by letting you commit your ZIG tokens to earn rewards. This means you can easily stake Zignaly tokens.

Key Features of Zignaly Staking:

- Earn Rewards: You stake Zignaly tokens (ZIG) to earn a yield, much like the staking rewards you'd see in PoS cryptos.

- Open to Everyone: It's designed to be user-friendly, often without any minimum stake requirements, which really lowers the barrier for everyday investors.

- Supports Multiple Networks: You can usually find Zignaly stake options on popular networks like Ethereum and BNB Smart Chain, giving you flexibility.

- Reward Calculation: Your rewards are typically based on how much ZIG you've staked and for how long.

- Unbonding Period: There's usually a 14-day "unbonding period," meaning your unstaked tokens will be available after that time

Whether you're looking to explore the ZIG ecosystem or even stake win token, ZIGSTAKE offers a straightforward and rewarding way to participate in the crypto economy without the complexity of running a full Proof of Stake validator node yourself. For all the details, check out the official Zignaly Help Center.

Real-World Impact and the Future of PoS

Proof of Stake isn't just a concept anymore; it's actively driving a new wave of blockchains and decentralized applications. Its focus on being energy-efficient and scalable perfectly fits the growing need for more sustainable and high-performing blockchain solutions.

We're seeing a big increase in point of stake participation models – things like liquid staking and user-friendly staking platforms are making it so much easier for average investors to get involved and contribute to network security.

As we move deeper into a decentralized future, Proof of Stake is set to be a cornerstone. It's truly pushing the boundaries of eco-friendly, scalable, and economically inclusive consensus designs that will power the next generation of Web3 innovation.

FAQs- Proof of Stake (PoS)

How does PoS work in crypto?

Proof of Stake (PoS) secures blockchains by choosing validators according to how much cryptocurrency they "stake" (lock up) as collateral. In proportion to their stake, validators propose and validate blocks, substituting a more effective consensus mechanism for energy-intensive mining. Honest validators earn rewards, while malicious actors risk losing their staked funds.

Which is better, PoW or PoS?

PoW (Bitcoin-style) offers decentralization and proven security, but uses a lot of energy. While PoS (Ethereum-style) is newer and less proven than PoW, but faster, scalable, and energy-efficient. Select PoS for environmentally friendly speed and PoW for dependability. Depending on your priorities.

Is proof-of-stake safe?

Yes, Proof-of-Stake (PoS) is secure and safe for blockchain networks when properly implemented. PoS validators "stake" cryptocurrency as collateral, which encourages honesty in contrast to energy-intensive Proof-of-Work (PoW) systems where dishonest behavior could result in the loss of funds. Cutting-edge defenses like decentralized validator pools and slashing penalties are used by contemporary PoS chains, such as Ethereum 2.0, to discourage attacks.

Bottom Line

So, what is PoS in crypto? It's the backbone technology of many of the most promising and powerful blockchain networks out there. From verifying transactions on a blockchain to encouraging community involvement and providing economic incentives, Proof of Stake (PoS) and related staking platforms like Zignaly staking are setting exciting new standards for efficiency and security.

Whether you're just dipping your toes into crypto or you're a seasoned investor, understanding how Proof of Stake (PoS) in blockchain works will help you better navigate and benefit from our decentralized future.